- MPFS Final Rule – https://public-inspection.federalregister.gov/2024-25382.pdf

- MPFS Final Rule CMS Fact Sheet – Calendar Year (CY) 2025 Medicare Physician Fee Schedule Final Rule | CMS

Conversion Factor – The final rule sets the PFS conversion factor at $32.35, a decrease of $0.94 (2.83%) from the CY 2024 conversion factor of $33.29. CMS estimates the overall impact of the MPFS final changes on otolaryngology for 2025 to be 0% (not including the 2.83% that all physicians are subject to).

G2211 – The rule finalizes the allowance of payment for the G2211 add-on code when reported by the same practitioner on the same day as an annual wellness visit, vaccine visit or any Medicare Part B preventative service.

Global Surgical Period Accuracy and the New GPOC1 Surgical Code – This rule finalizes a policy to broaden the applicability of the transfer of care modifier -54 for all 90-day global surgical packages in cases where the provider plans to only furnish the surgical procedure itself. The final rule will require modifier -54 to be appended to the initial procedure when the practitioner only intends to perform the procedure and does not intend to provide the post-operative care in both formal and informal scenarios.

For 2025, CMS is also finalizing an add-on code for post operative care which is provided by a practitioner other than the one who performed the initial procedure (or another practitioner in their practice.) Beginning January 1, 2025 add-on code G0559, post-operative follow-up visit complexity inherent to evaluation and management services addressing surgical procedure(s), provided by a physician or qualified health care professional who is not the practitioner who performed the procedure (or in the same group practice) will be active. It is the intent of this code to adequately reimburse practitioners who are providing the previously mentioned follow-up care for patients who they are not familiar with. The RVU value for G0559 was finalized as 0.16 with a time of 5.5 minutes.

Telehealth Services under the PFS

Absent Congressional action, beginning January 1, 2025, the statutory limitations that were in place for Medicare telehealth services prior to the COVID-19 Public Health Emergency (PHE) will once again take effect for most telehealth services. These include geographic and location restrictions on where the services are provided, and limitations on the scope of practitioners who can provide Medicare telehealth services. This will discontinue the inclusion of audiologists and speech-language pathologists as authorized telehealth providers.

For CY 2025, the agency is finalizing that an interactive telecommunications system may include two-way, real-time, audio-only communication technology for any Medicare telehealth service furnished to a beneficiary in their home, if the distant site physician or practitioner is technically capable of using an interactive telecommunications system, but the patient is not capable of, or does not consent to, the use of video technology.

In-Office Tympanostomy Tubes

In the proposed rule, CMS requested comments on options for more accurately reimbursing in-office tympanostomy tube placement. CMS acknowledged the need to better describe and reimburse the resources associated with innovative tympanostomy tube delivery using CPT code 0583T; The second being the establishment of an add on G-code with inputs based on the procedure being done in an office setting, for patients at high risk of movement, such as pediatric patients. In the final rule CMS elected not to finalize national pricing for CPT code 0583T at this time. The majority of comments, including those submitted by the AAO-HNS, were in favor of the add-on G-code, which CMS is electing to finalize as part of this rule. HCPCS code G0561 Typmanostomy with local or topical anesthesia and insertion of a ventilating tube when performed with tympanostomy tube delivery device, unilateral (list separately in addition to 69433) is to be billed in conjunction with CPT code 69433 in order to describe the additional resource costs associated with using the innovative delivery devices and/or systems which fall under emerging technology. This new add-on code should not be used in conjunction with code 0583T.

CPT Code 95800 (HSAT)

In the proposed rule CMS requested comments on whether CPT code 95800 should be included on the misvalued code list. The nominator suggested that the code be included based on an alleged shift towards disposable devices and away from reusable devices. Based on lack of sufficient evidence and clear consensus as to which is more common, CMS finalized their proposal to not include this code on the misvalued list and will reassess when more information is made available.

CPT Codes 10004, 10005, 10006 and 10021 (Fine Needle Aspiration)

In the proposed rule the CPT codes for fine needle aspiration were nominated as potentially misvalued. The AAO-HNS’ comments stated our disagreement with that fact and in the final rule, CMS elected to not include these codes as potentially misvalued, citing that the “valuation accurately reflects the typical work and direct PE inputs involved in furnishing FNA services.”

CPT Codes 60660 and 60661 (formerly 6XX01 and 6XX02)- Percutaneous Radiofrequency Ablation of Thyroid

In the final rule, CMS finalized the valuation and established the final CPT codes for percutaneous radiofrequency ablation of thyroid. These codes, listed in the proposed rule as 6XX01 and 6XX02 now have the identifying CPT codes of 60660 and 60661 respectively. CMS finalized the valuation as listed in the proposed rule and proposed by the RUC. Code 60660 (Ablation of 1 or more thyroid nodule(s), one lobe or the isthmus, percutaneous, including imaging guidance, radiofrequency) received a work RVU of 5.75. Code 60661 (Ablation of 1 or more thyroid nodule(s), additional lobe, percutaneous, with imaging guidance, radiofrequency) received a work RVU 4.25.

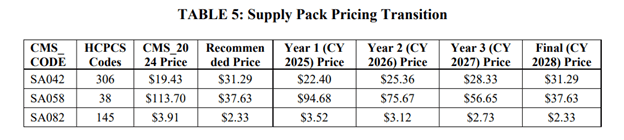

Supply Pack Pricing Update

In the proposed rule, 18 codes related to supply packs were identified as incorrect. Upon review, CMS reported in the final rule that 15 of the supply packs referenced are included in the direct PE inputs for over 100 codes. For this reason, they are not finalizing a pricing update at this time. For the 3 remaining codes, CMS finalized a -year price transition to occur between 2025 and 2028. The chart below shows the finalized changes and schedule.

Quality Payment Program

Performance Threshold

In the rule, CMS finalized the decision to maintain the current performance threshold policies, meaning the performance threshold will remain at 75 points for the 2025 calendar year/performance period, or the 2027 MIPS payment year.

Addition of Adult COVID-19 Vaccination Status:

This rule finalized 5 new quality measures, including Q506: Positive PDL1 Biomarker Expression Test Result Prior to First Line Immune Checkpoint Inhibitor Therapy, Q507: Appropriate Germline Testing for Ovarian Cancer Patients, Q508: Adult COVID19 Vaccination Status, Q509: Melanoma: Tracking and Evaluation of Recurrence and Q510: First Year Standardized Waitlist Ratio (FYSWR.)

Removal of Improvement Activity Weights

The final rule removes improvement activity weighting and streamlines the reporting requirements for the performance category.

The final rule also removes IA_EPA_1: Provide 24/7 Access to MIPS Eligible Clinicians or Groups Who Have Real-Time Access to Patient’s Medical Record from use beginning in January 2025.

Changes to MVPs

The final rule changes the support requirements for MVPs. Participants will no longer be required to select a population health measure as part of their MVP registration. One will be assigned if it is available and appropriate.

The rule finalizes two QCDR measures of interest to otolaryngology from the Ear, Nose and Throat MVP. The measures removed are AAO16 (Age-related Hearing Loss: Audiometric Evaluation) and AAO23 (Allergic Rhinitis: Intranasal Corticosteroids or Oral Antihistamines.)